So, you’ve set your sights on buying a house in the beautiful state of Maryland? Well, you’re in luck! In this article, we’re going to dive into the ins and outs of how you can make that dream a reality. From understanding the local housing market to navigating the homebuying process, we’ve got you covered. So, grab a cup of coffee, sit back, and let’s explore how you can buy a house in Maryland!

When it comes to purchasing a home in Maryland, it’s essential to have a solid plan in place. First things first, familiarize yourself with the local real estate market. Maryland offers a diverse range of neighborhoods and communities, each with its own unique charm and character. Whether you’re drawn to the historic streets of Annapolis or the bustling city life of Baltimore, there’s something for everyone in the Old Line State.

Now, let’s talk about the logistics. From finding a trusted real estate agent to securing financing, there are several steps involved in the homebuying process. Don’t worry, though – we’ll break it down for you in simple terms, making it easier to navigate. So, if you’re ready to embark on this exciting journey, let’s dive right in and explore how you can buy a house in Maryland!

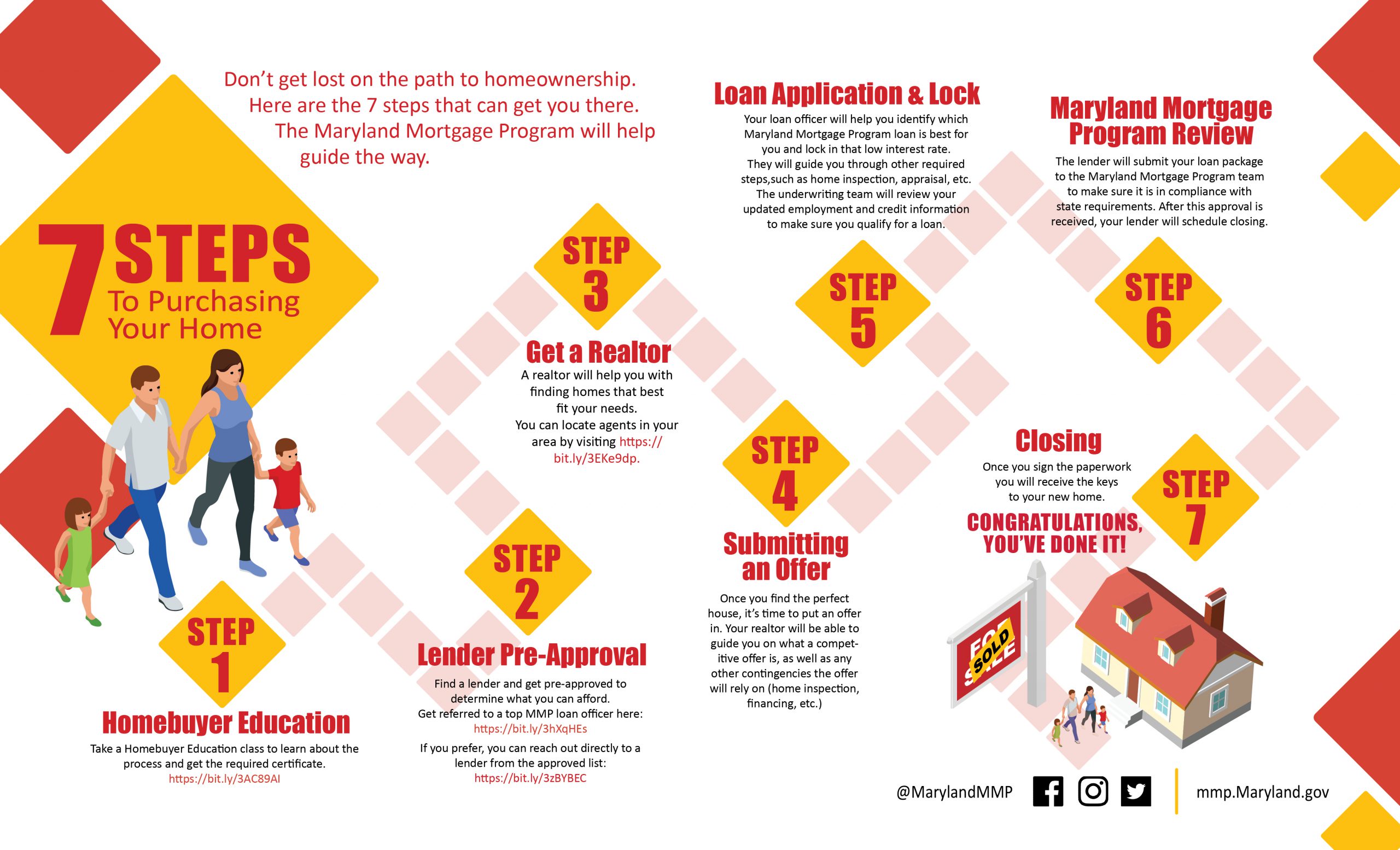

If you’re wondering how to buy a house in Maryland, here’s a step-by-step guide to help you through the process:

- Save for a down payment: Start by saving money for a down payment on your dream home.

- Check your credit score: A good credit score is essential for getting a favorable mortgage rate.

- Get pre-approved for a mortgage: This will give you a better idea of how much you can afford to spend.

- Find a real estate agent: Work with an experienced agent who knows the Maryland housing market.

- Start house hunting: Visit open houses and schedule private showings to find the perfect home.

- Make an offer: Once you’ve found the right house, submit an offer through your real estate agent.

- Negotiate and finalize the deal: Negotiate with the seller to reach a mutually beneficial agreement.

- Complete the mortgage process: Work with your lender to complete all the necessary paperwork and secure your mortgage.

- Close on the house: Attend the closing meeting to sign the final documents and officially become a homeowner in Maryland!

How Can I Buy a House in Maryland?

Maryland is a beautiful state with a vibrant real estate market, making it an attractive place to buy a house. If you’re wondering how to navigate the home-buying process in Maryland, you’ve come to the right place. In this article, we’ll provide you with a step-by-step guide on how to buy a house in Maryland, including important considerations and resources to help you make informed decisions.

Step 1: Determine Your Budget and Financing Options

Before you start searching for your dream home, it’s crucial to determine your budget. Consider your income, expenses, and existing financial obligations to get an idea of how much you can afford to spend on a house. Additionally, it’s essential to explore financing options such as mortgages and loans to understand how much you can borrow.

One of the first steps in the home-buying process is getting pre-approved for a mortgage. This involves providing your financial information to a lender who will evaluate your creditworthiness and determine how much they are willing to lend you. Being pre-approved will give you a clear budget and help you narrow down your search to houses within your price range.

Step 1.1: Research Maryland’s Real Estate Market

Maryland’s real estate market is diverse and dynamic, with different regions offering varying property prices and market conditions. Take the time to research the different areas in Maryland to identify the locations that best suit your needs and preferences. Consider factors such as proximity to amenities, schools, transportation, and your daily commute.

Once you have identified the areas you’re interested in, start monitoring the real estate market in those regions. Pay attention to trends in property prices, inventory levels, and average days on the market. This information will help you gauge the competitiveness of the market and make more informed decisions when it comes to making offers on properties.

Step 1.2: Explore Financing Options

When it comes to financing your home purchase, there are several options available in Maryland. Traditional mortgages offered by banks and credit unions are a popular choice. These mortgages typically require a down payment, and the terms and interest rates will vary based on your creditworthiness and financial situation.

In addition to traditional mortgages, you may also explore other financing options such as government-backed loans like FHA (Federal Housing Administration) loans or VA (Veterans Affairs) loans for eligible veterans and active-duty military personnel. These loans often have more flexible eligibility criteria and may require a lower down payment.

Step 2: Find a Real Estate Agent

Navigating the home-buying process can be complex, especially if you’re a first-time buyer. Working with a knowledgeable and experienced real estate agent can make the process smoother and more efficient. A real estate agent can help you find suitable properties, negotiate offers, and guide you through the paperwork and legal aspects of the transaction.

When choosing a real estate agent, look for someone who has a thorough understanding of the local market and has experience working with buyers in Maryland. Ask for recommendations from friends, family, or colleagues who have recently bought a house in the area. Additionally, consider interviewing multiple agents to find someone who you feel comfortable working with and who understands your specific needs.

Step 2.1: Benefits of Working with a Real Estate Agent

Working with a real estate agent has several benefits. Firstly, they have access to a wide range of properties through multiple listing services (MLS) and can help you find homes that meet your criteria. They can also provide valuable insights and advice based on their knowledge of the local market.

Furthermore, a real estate agent can assist with the negotiation process, helping you secure the best possible deal on your dream home. They can handle the paperwork and legal aspects of the transaction, ensuring that everything is in order and that your interests are protected.

Step 2.2: Questions to Ask Your Real Estate Agent

When interviewing potential real estate agents, consider asking the following questions to help you make an informed decision:

1. How long have you been working as a real estate agent in Maryland?

2. Can you provide references from previous clients?

3. What is your approach to helping buyers find their ideal home?

4. How familiar are you with the neighborhoods I’m interested in?

5. What is your availability and preferred method of communication?

By asking these questions, you can gauge the agent’s experience, knowledge, and compatibility with your needs, increasing the likelihood of a successful partnership.

Step 3: Begin Your House Hunt

Once you have determined your budget, explored financing options, and secured the services of a real estate agent, it’s time to start your house hunt. This is an exciting part of the process where you get to explore different properties and envision yourself living in them.

Your real estate agent will provide you with listings that meet your criteria, and you can also search online platforms and attend open houses to view properties. As you visit different homes, pay attention to factors such as the condition of the property, its location, and any potential repairs or renovations that may be needed.

Step 3.1: Making Offers and Negotiating

When you find a property that you’re interested in, your real estate agent will guide you through the process of making an offer. They will help you determine an appropriate offer price based on market conditions and comparable sales in the area.

Negotiating the offer is a crucial step in the home-buying process. Your agent will communicate with the seller’s agent and work to secure the best possible terms for you. This may involve multiple rounds of negotiations until both parties reach an agreement.

Step 3.2: Conducting Inspections and Due Diligence

Once your offer is accepted, it’s important to conduct inspections and due diligence to ensure that the property is in good condition and meets your expectations. Hire a professional home inspector to evaluate the property’s structural integrity, electrical systems, plumbing, and other crucial aspects.

During this stage, you may also need to conduct additional inspections, such as termite inspections or environmental assessments, depending on the property’s location and specific characteristics. Your real estate agent can help coordinate these inspections and provide recommendations for reputable professionals.

In conclusion, buying a house in Maryland requires careful planning, research, and the assistance of professionals. By following the steps outlined in this article and working with a knowledgeable real estate agent, you can navigate the process with confidence and find your dream home in the beautiful state of Maryland.

Key Takeaways – How Can I Buy a House in Maryland?

- Research the housing market in Maryland to understand prices and trends.

- Save money for a down payment and closing costs.

- Get pre-approved for a mortgage to know your budget.

- Find a trusted real estate agent who knows the Maryland market.

- Visit open houses and schedule private viewings to find the right home.

Frequently Asked Questions

1. What are the steps involved in buying a house in Maryland?

Buying a house in Maryland involves several important steps. First, you should start by determining your budget and getting pre-approved for a mortgage. Then, you’ll need to find a trusted real estate agent who can help you search for properties that meet your criteria. Once you’ve found a house you’re interested in, you’ll need to make an offer and negotiate with the seller. If your offer is accepted, you’ll enter into a sales contract and begin the process of securing financing, completing inspections, and conducting a title search. Finally, you’ll attend the closing, where the necessary paperwork will be signed and you’ll officially become the owner of the house.

It’s important to note that each step of the process may have its own specific requirements and timelines, so it’s crucial to work closely with your real estate agent and other professionals involved to ensure a smooth and successful transaction.

2. What are the financing options available for buying a house in Maryland?

There are several financing options available for buying a house in Maryland. One common option is a conventional mortgage, which typically requires a down payment of at least 3% to 20% of the purchase price. Another option is an FHA loan, which is insured by the Federal Housing Administration and often requires a lower down payment, making it more accessible for first-time homebuyers. Additionally, there are VA loans available for eligible veterans and active-duty military personnel, as well as USDA loans for properties located in rural areas.

It’s important to explore different financing options and compare interest rates, terms, and eligibility requirements to determine the best fit for your specific situation. Consulting with a mortgage lender can provide valuable guidance and help you navigate the financing process.

3. What are some important factors to consider when choosing a location in Maryland to buy a house?

When choosing a location in Maryland to buy a house, there are several important factors to consider. First, think about your lifestyle and preferences. Do you prefer a bustling city or a quiet suburban neighborhood? Consider the proximity to amenities such as schools, shopping centers, and healthcare facilities. Additionally, think about your commute to work and the availability of public transportation options.

It’s also important to research the local real estate market and consider factors such as property values, crime rates, and future development plans. Take the time to visit different neighborhoods and get a feel for the area before making a decision. Working with a knowledgeable real estate agent who is familiar with the Maryland housing market can also provide valuable insights and guidance.

4. What are some closing costs associated with buying a house in Maryland?

When buying a house in Maryland, there are several closing costs that buyers should be prepared for. These costs can vary depending on factors such as the purchase price of the house and the specific terms of the transaction. Some common closing costs include lender fees, appraisal fees, title insurance, escrow fees, and recording fees. Additionally, there may be costs associated with inspections, surveys, and attorney fees.

It’s important to carefully review the estimated closing costs provided by your lender and budget accordingly. Working with a real estate agent and a trusted mortgage lender can help you understand and navigate the various closing costs associated with buying a house in Maryland.

5. Are there any first-time homebuyer programs or incentives in Maryland?

Yes, there are several first-time homebuyer programs and incentives available in Maryland. The Maryland Mortgage Program (MMP) offers a variety of loan products and assistance programs specifically designed for first-time homebuyers. These programs can provide down payment assistance, reduced interest rates, and more flexible eligibility requirements.

In addition to state programs, there may also be local incentives and grants available in certain counties or municipalities. It’s important to research and explore all available options to maximize your chances of accessing these programs and incentives. Consulting with a real estate agent and a mortgage lender who are knowledgeable about first-time homebuyer programs in Maryland can help you navigate the process and take advantage of any available benefits.

Buying a Home in Maryland [PROS and CONS]

Final Thoughts on Buying a House in Maryland

So, you’re ready to buy a house in Maryland? Congratulations! You’re about to embark on an exciting journey towards homeownership in one of the most charming and diverse states in the country. Now that you’ve learned the ins and outs of the homebuying process in Maryland, it’s time to put your newfound knowledge into action.

Remember, buying a house is not just a financial investment, but also an emotional one. Take your time, do your research, and don’t be afraid to ask for help along the way. From exploring different neighborhoods to finding a trusted real estate agent, every step you take will bring you closer to finding your dream home.

As you navigate the world of real estate in Maryland, keep in mind the importance of optimizing your search for the best results. Use relevant keywords when searching online, like “houses for sale in Maryland” or “realtors in Baltimore.” By following SEO best practices, you’ll increase your chances of finding the perfect home faster and more efficiently.

In conclusion, buying a house in Maryland is an exciting and rewarding process. With the right knowledge, preparation, and a sprinkle of patience, you’ll be well on your way to becoming a proud homeowner in this beautiful state. So, go ahead and take that leap of faith. Your dream home in Maryland is waiting for you!